12 Reasons Why Fintech Startups Fail

Sector: Digital Product

Author: Chintan Bhatt

Date Published: 05/11/2021

Contents

- 12 Reasons behind Why Most Fintech Startups Fail

- Not getting Enough Funds

- Choosing the Wrong VC

- Going too much Compliant

- Working like Another Tech Startup

- Thinking of Cost as a Factor to Eliminate Competition

- Underestimating your Competitors

- Skipping to Understand your Customers

- Overloading their Product Offerings

- Skipping to Innovate with Technical Functionalities

- Not having Enough Clarity on the Revenue Model

- Not Considering Legal Aspects

- Choosing the Development Partner Randomly

- Wrapping Up

Fintech is one of the most modern trends currently in the technology sector. The fintech market is predicted to hit around $460 billion by the year 2025. Fintech Startups are driving this flourish and steering digital transformations.

They are launching innovative products and services using technological innovations. However, achieving success in this domain is full of challenges. Though fintech startups initiate with suitable investments and funding, there are higher business risks.

Most Fintech startup owners think they are building the next million-dollar business. But, they face problems with scaling their business. They also face issues in making users pay for their products.

Read More: Top Fintech Trends in 2021

he majority of Fintech startups make mistakes in diverse areas that lead to their failures. Besides, wrongly targeted customers, funding, and technology are not merely the challenges in the fintech ecosystem. These fintech startups even face issues with fierce competition and chosen revenue models.

Here is how fintech startups meet failures and how they can avoid the same.

12 Reasons behind Why Most Fintech Startups Fail

1. Not getting Enough Funds

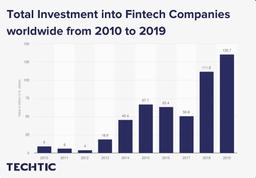

Drastic investment growth is observed in the fintech sector with USD 135.7 billion invested in the fintech industry in 2019 when compared to USD 9 billion in the year 2010.

Even after seeing such investment growth in the Fintech industry, if you’re not getting enough funds, your Fintech startup is likely to fail.

For enabling Fintech startups with precise tools, top talent, and other essential resources, you go through ongoing expenses. So, having funds upfront with continuous investments is significant for these fintech startups.

Underfunding makes things out of control for Fintech businesses and leads to failures. With fintech startup costs, you also need to sustain your business until you have a strong proof of concept. And later, you can have a steady flow of paying customers.

However, prior research on your products is quite vital. You have to design a strong business plan and include all the possible costs to make sure you generate enough funds, keeping your business live.

You should opt for developing a Minimum Viable Product (MVP) to prove your business idea and concept.

An MVP not only assists you in testing your business concept but also gets your audience’s feedback prior to launch. As an outcome, you can evade financial losses and attract continuous funds.

Investors are a crucial part of initiating a fintech startup. And getting enough funds from them will increase the chances of success with returns.

2. Choosing the Wrong VC

Though funds are vital, the ones giving them to you also matter. The venture capitalists you partner with don’t merely offer their money. However, they even attach their brand name and specializations to assist you in your business. If you select the wrong financial partner, it could lead to considerable errors.

It is always beneficial if you choose an investor with proficiency in the financial domain. The investment partner from the same field assists you in navigating the industry as their know-how is crucial to your business success. Also, funding from investors not having financial backgrounds can stop your financing shortly.

You need to interact with your investors on their participation in your business. You also need to clarify what category of reporting they anticipate from you. And the governance they prefer for the company.

Dealing with these expectations openly and timely will boost the chances of your business success. The promising start initiates a drive from the previous year when VC-backed fintech organizations raised $41.7 billion in the second-biggest annual total of the previous decade.

3. Going too much Compliant

Complying with regulations is essential. But unnecessarily or complying too much can lead to a quick death for your fintech startup.

A robust complaint strategy is needed. Stakeholders specifically in Fintech talk about cyber laws and a lot of other compliances. However, you don’t need all of them. Find out the best ones considering your product offerings and business geographies.

Cyber laws deal with legal informatics, eCommerce sales, and information security. Fintech companies are also exposed to anti-money laundering, funding regulations, and payment security.

So, it needs precise compliance planning when launching your fintech startup. You need to plan for expenses and decide on compliance options.

Being too compliant without a need should be avoided. However, you must take guidance from a professional attorney when initiating your fintech. A failure to do so may lead to a collapse.

4. Working like Another Tech Startup

Not all startups are similar, especially fintech. The working models and strategies to move ahead are entirely different from Fintech startups. However, they make a significant error in setting up their business operations like other tech startup.

Most of them lack an understanding of the business model. And they are not competent to innovate with their product offerings.

If a fintech wants to thrive, they require clutching the mindset of their audiences. They need to find out how they spend money, what are their investment anxieties and much more. Further, they require understanding the challenges from both fronts, on a consumer and company level, as they both think differently.

You need unique marketing strategies compared to other startups. As a startup founder, you cannot compromise on individuality and do all stuff just as any other startup is doing. A complete understanding of your users and marketplace is critical to getting this done correctly.

5. Thinking of Cost as a Factor to Eliminate Competition

You may think of lowering your product costs with a thought to eliminate the competition. But, when your loyal customers learn of your regular discounting practices, it merely gets worse with time. Especially, when your usual product prices are offered at a discount.

Also, as your previous discounts have lowered the product value, what about your future profits and why would users pay additional later?

So, discounting leads to a poor example which reduces your future business opportunities to increase margins. Hence, don’t compete over costs, especially if you are a Fintech startup.

6. Underestimating your Competitors

Numerous fintech startups are emerging and thinking that can’t affect you, you’re making one of the biggest mistakes.

Here are the ways to not underestimate your competitors –

- You require to keep evolving your product and services for your customer base and investors to ensure your competitors can’t allure your customers

- You must upgrade and update your product regularly with technological innovations

- Keep an eye right on your competitors’ decision-making processes and business moves

- Adopt better marketing strategies and try to introduce new business tactics compared to competitors

Even if you have turned into a popular name in the Fintech domain, you are required to keep a close watch and track your competitors as you never know when things get changed in this highly competitive space.

7. Skipping to Understand your Customers

It is highly required to understand the approach consumers take with their finances. If you can’t take hold of this, you can’t be successful as a fintech startup.

Going too much behind vendors and competitors, you may miss out to understand your core customers & their needs.

Listening to your customers and positively turning consumer feedback into new product features is an immense challenge. However, doing so can lead you to fruitful outcomes, especially if you are a Fintech startup.

You require knowing how your audience in every segment saves, invests, and deals with their finances. For instance, when anticipating mobile applications for banking, consumers aged around 20 are interested in advanced financial tools. In contrast, those in 30-somethings demand enhanced debit card rewards. In the interim, consumers aged 40 and more are merely interested in interest rates.

So, you need to discover such insights to understand your consumer base.

However, age is only one factor. Other characteristics such as education level, gender, and financial status, amongst other stuff, need to be analyzed to understand your customers.

Also, from the customer’s viewpoint, accepting and using a fintech product takes a detailed understanding. So, skipping to understand your customers will lead to definite failures.

People prefer what they know, and their behaviors can be tracked. So, pitching your users as per their behaviors will lead to a flourish in the Fintech space.

As per research, people prefer the market’s largest segment will be Digital Payments with an expected transaction value of US$ 8,266,917 million in the year 2024.

8. Overloading their Product Offerings

As technology and innovation are the strong points of fintech, they assume that all customers want more. So, the Fintech startups join the race of new features, swifter services, and more automated solutions.

However, they forget to consider and know what customers require and overload their product offerings.

Fintech startups should keep the customer experience as a top priority. It is simple to lose sight of what your consumers are looking for through your products when upgrading to advanced technology.

So, when optimizing and updating your products, ensure you listen to your customer base.

9. Skipping to Innovate with Technical Functionalities

New technical functionalities, such as Artificial Intelligence (AI) and Machine Learning (ML) features, will take the guesswork out of financial decision-making. Innovative learning applications further trim down unconscious savings and investment decisions.

With chatbots, you can keep your staffing costs down. You can identify and take action on fraud by features offering you insights into your payment history.

All these technical functionalities can help Fintech startups to innovate with technology. Skipping continuous innovations once the product is ready can lead to failures.

So, Fintech startups need to streamline their products and services by introducing new features regularly.

To an extent, Fintechs have led the way in user-friendliness, and have enabled steady experiences across diverse channels.

10. Not having Enough Clarity on the Revenue Model

Any startup’s revenue model is significant for its business success. However, for a fintech founder, it is highly critical. That is because customers question fintech startups on their revenue models. For instance, consumers think, when asked for a higher product price by a fintech startup that it will have a share of investor gains.

However, winning consumer confidence is vital for fintech companies and is directly attached to their revenue model.

As per Forbes, Startups that have received the most funding to date create a lower-cost product version of a current financial product. And customers are already paying for that as compared to a new product with a different value proposition.

The startups with lower setup and distribution costs use the influence of their networks. So, for such other scenarios, it is essential to decide the precise revenue model. And settle on how as a fintech startup, you will make money in the coming time?

You need to be clear on the revenue sources, be it from the customers or through digital advertising. A business model that is merely based on creating new users without a monetization strategy may lead to failures.

11. Not Considering Legal Aspects

Along with financial laws, fintech companies need to stay compliant with the legal aspects to operate smoothly. This comprises elements such as know-your-customer (KYC), anti-terrorist funding regulations, and consumer data protection, to name a few.

However, many fintech owners do not research well on the legal aspects and augment the risk of product failure.

The financial services are immensely regulated and are highly in-depth when it comes to the legal space. So, it is significant to include legal aspects when creating a business plan. This includes precise licensing, and its attached laws, especially for fintech startups building a software solution.

12. Choosing the Development Partner Randomly

You need to smartly select your development partner. You can hire a development partner with a team or an individual who can work as your own team member.

You need to thoroughly check out if your development partner has relevant experience and proficiency during the selection process. If you go with beginners for your Fintech app development, you may end up spending too much.

Your development partner should meet all the needed regulatory practices and be well-versed with current cybersecurity needs. He should have a robust risk mitigation plan ready.

Are you exploring a specialist fintech development partner? If yes, check out our fintech portfolio and connect to discuss how we can assist your fintech startup!

Wrapping Up

When you start a fintech startup, it may feel like it’s you alongside the entire world. However, to avoid failures mastering customer experiences and backing client support services is something fintech startups should follow in 2021.

No matter how advanced your product or service is, customer engagements are still critical, especially for business sectors dealing with finances.

Failures take place, however, so do business successes. So, learn from the success and mistakes of other Fintech Startups and make sure you can enable precise strategies.

At Techtic, being a leading Fintech App Development Company, we have assisted emerging fintech startups worldwide. Initiate your journey towards development and releasing a comprehensive Fintech product on the App Store with us.

Latest Tech Insights!

Join our newsletter for the latest updates, tips, and trends.