Key Fintech Statistics 2022: Market Share & Data Analysis

Sector: Digital Product

Author: Chintan Bhatt

Date Published: 08/31/2020

Contents

Fintech is one of the hottest industries in the world today. With the viral disease rattling our lives and livelihood, it would be really difficult to imagine a life without fintech and all fintech’s features and benefits.

Several industries and businesses across the globe are turning to fintech to solve some of the most plaguing concerns with respect to payments and more.

Read More: Fintech Trends to Watch in 2022

This seems to be a game-changing moment in the market, where fintech companies are influencing everything they touch. If you’re an aspiring business owner looking to venture into the world of fintech, you need to know some basic statistics and numbers in the industry.

In this post, we have compiled some of the most insightful statistics on the fintech industry you should know about.

Read on.

General Fintech Statistics

1. As per Statista.com, 66.7% share of bank executives believe Fintech will impact wallets and mobile payments globally.

2. As per Statista.com, 38% share of U.S. personal loans granted by Fintech.

3. In February 2020, there were 8,775 financial technology (Fintech) startups in the Americas, there were 7,385 such fintech startups in Europe, the Middle East, and Africa, and there were 4,765 fintech startups in the Asia Pacific region. Source – Statista.com

4. The global fintech market was worth $127.66 billion in 2018, and it is expected to reach $309.98 billion at a CAGR Of 24.8% through 2022. Source – PRNewswire.com

5. According to Fintech Global, Latin America’s fintech market could exceed $150bn by 2021.

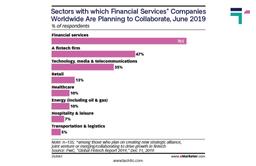

6. Recent PwC survey of financial services companies worldwide shows that among companies that wanted to collaborate with other sectors for growth, 47% were likely to collaborate with a fintech firm.

7. As per Statista.com, in 2020, North American banks were expected to spend up to 40 percent of their IT budget on new technology, while European banks invested almost 30 percent.

Digital Banking & Payment Statistics

1. In 2018, about 61 percent of Americans used digital banking, which is set to rise to 65.3% by 2022 as per Statista.com.

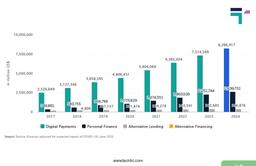

2. Recent research of Statista.com, the market’s largest segment will be Digital Payments with a total transaction value of US$4,406,431m in 2020 and it is expected that it will be reached US$8,266,917m in 2024.

3. The average transaction value per user in the Digital Payments segment is projected to amount to US$1,269 in 2020 and it is expected to reach US$38,706 in 2024. Source – Statista.com

4. In 2018, the share of the population using digital banking in the United States is about 61 percent and it is set to rise to 65.3 percent by 2022. – Source – Statista.com

5. As per the research of CACI Limited, by the year 2022, mobile transactions are projected to grow by 121%. This will eventually comprise 88% of all banking transactions.

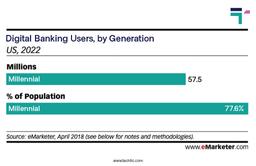

6. As per eMarketer.com analysis, by the year 2022, almost 78% of the United States millennial population will become digital banking users.

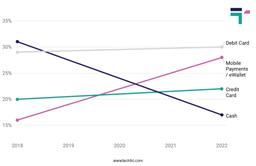

7. As per Worldpay research, by 2021, credit cards, debit cards, and mobile wallets are projected to surpass cash at all points of sales worldwide.

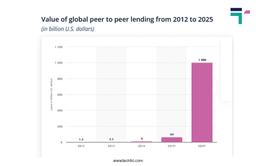

8. As per the research of Statista.com, Peer-to-peer (P2P) (digital lending) was worth US$3.5 billion in 2013 and is expected to rise to US$1000 billion in 2025.

9. As per Juniper Research, Apple Pay, Google Pay, and Samsung Pay are set to own 56% of the combined market share of mobile payments in 2021.

10. PayPal is one of the leading mobile payment platforms worldwide which has a net payment volume amounted to 221.7 billion U.S. dollars in the 2nd quarter of 2020 as per the research of Statista.com.

11. According to Juniper Research, 1 in 2 Global adult populations in the world will have access to mobile banking in 2021.

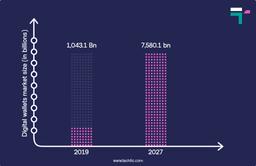

12. As per research by Valuates Reports, The digital mobile wallet market size was valued at USD 1,043.1 bn in 2019 and is predicted to reach USD 7,580.1 bn by 2027, growing at a CAGR of 28.2% from 2020 to 2027.

Financial Technology Statistics

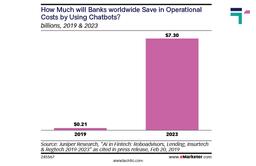

1. As per a study from Juniper Research has found that using chatbots will save banks $7.3 billion globally by 2023, up from an estimated $209 million in 2019.

2. According to the TMR report, the global market for cryptocurrency was valued at around US$0.5 bn in 2016 and is anticipated to expand at a CAGR of around 31.3% from 2017 to 2025 to attain the value of US$6.7 bn by the end of the forecast period.

3. As per the PWC report, 77% of financial service incumbents are expected to adopt blockchain in fintech for in-product processes or systems by 2020.

4. As per the analysis of Grand View Research, The global regtech market size was estimated at USD 4.3 billion in 2019 and it is expected to reach USD 55.2 billion by 2025 at a compound annual growth rate of 52.8%.

5. According to a report from IHS Markit, the business value of AI (Artificial Intelligence) in North American banking was estimated at $14.7 billion in 2018 and it is expected to reach $79.0 billion in 2030.

6. As per the analysis of Juniper Research, Successful banking-related chatbot interactions will grow 3,150% between 2019 and 2023.

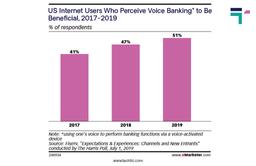

7. Recent surveys from Fiserv stated that half (51%) of US internet users said they saw benefits of voice banking, up from 41% in the 2017 survey.

Wrapping Up

It’s not just the present that looks promising for fintech but the future, too. This is the right time to start a fintech business or grow an existing one. For that you must have a fintech app for your fintech startup business and for developing a fintech app, you must find the right Fintech App development company.

What are some of the interesting statistics that you have come across or read about fintech? Share them in your comments below or text directly in the contact us form.

Latest Tech Insights!

Join our newsletter for the latest updates, tips, and trends.