Fintech App Development for Startups: 7 Challenges, Solutions

Sector: Digital Product

Author: Chintan Bhatt

Date Published: 07/13/2020

Fintech Mobile Apps are the next trillion-dollar industry.

In 2019 alone, Fintech was the fastest growing mobile app category in the US, with a 53% boost since 2017. With a healthy CAGR of 6% till 2022, it’s one of the most lucrative mobile app businesses to step-in right now.

May it be shopping for groceries or procuring loans, all the key payment avenues now have a digital option. Our reliance on e-payment methods, mobile wallets and banking apps is slowly progressing from a “luxury” to a “need”.

Nearly 90% of users who own a smartphone are expected to make a digital payment in 2020. Such wide penetration and fast adoption put Fintech Apps on the frontlines for investment summits. Fintech attracted $100 billion in investments according to Forbes.

But even with all its merits, Fintech App Development isn’t exactly a walk in the park. It’s heavily surrounded by compliance, security and institutional challenges.

From a business standpoint, you would want to know if the rewards weigh out the challenges, and how to overcome them.

At Techtic, we have been closely observing the industry, and we have some strategic insights to share, with anyone who is looking to bet on a Fintech App.

Types of Fintech Apps

The spectrum of Fintech apps has been growing in scale and diversity, with innovative ideas pouring into the market.

Fintech software Development Services are actively targeting apps that fulfil any market gap that involves a financial transaction, whether B2C or B2B. The key categories where Fintech is quickly growing are mentioned below.

1. Financial Lending Apps

2. Banking Apps

- Gone are the days when you had to rush to a Brick-and-Mortar bank to get your passbook updated.

- From customer support to fund transfer, everything is handled on the app. Axis Bank even offers new savings account registration through its mobile app.

3. InsureTech Apps

- InsureTech is a subset of Fintech that’s booming at an equally fast pace.

- Insurance providers are automating claim application, verification and reimbursement using smartphone Apps.

- Not only it saves time, but it also boosts consumer confidence in the insurance product, helping drive more sales.

- Geico is one such InsureTech provider that offers insurance services via its mobile App.

4. Payment Apps

- Payment Apps are the most publicly visible implementation of Fintech that has completely transformed personal payments.

- Mobile wallets provide customers to go cashless while improving the payment experience at vendor outlets.

- The highly popular mobile payments app, Paytm, has garnered over 350 million users – that’s nearly a third of India’s population.

5. Investment Apps

- Mobile investment apps have grappled a multitude of investment avenues such as Stock Trading, Mutual Fund investments, ETFs.

- Fractional Share Investing and Portfolios, Retirement Investing and so on.

- These apps act as an interactive front-end for end-users to take investment decisions.

- Ameritrade, SoFi and Ally are some examples that are leading the industry.

Key Challenges Faced in Fintech App Development

Launching a Fintech App will pose two types of challenges – Strategic Challenges and Technical Challenges.

Strategic challenges include readying the pitch deck, securing funding and meeting government compliances. These challenges are related to organizational structure rather than the app itself.

Technical Challenges pertain directly to the ideation, development and marketing of the Mobile App. These challenges are related to the technology and engineering of the product.

In this article, we’ll address a mix of both the challenges, so that you can gain a bird’s eye view of the industry. We have also tried to offer solutions to every challenge with empirical evidence.

1. Understand Business Goal and Target Audience

Problem Statement – Discovering a market gap and ideating a solution that can be facilitated over an App.

Conceptualizing an idea that works both on paper and in the wild, is always the foremost challenge. Fintech is a diverse domain, and you can choose from a number of sectors, as per feasibility and scope of innovation.

In order to get your brain juices flowing, here is a sample list of questions that you’ll need to answer at this stage. Remember that initial ideation is the fundamental to the success of the app.

Questions to Ask

- What is such a Fintech loophole, market gap or user need that doesn’t have an App-based solution yet?

- How many users does this market gap affect?

- What core benefits will the users obtain from the App?

- What are the current alternatives to the solution and why are they better?

- What is the scope of innovation?

- Is the idea technically feasible?

Solutions

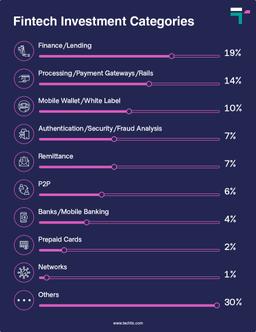

1. Identify a Sector – The hunt for the idea begins by diving deep into market studies. Fintech has 9 major sectors that receive the most fundings. These are:

- Finance/Lending

- Payment processing

- Mobile Wallets

- Transactional Security Services

- Remittance

- P2P Lending

- Mobile Banking

- Prepaid Cards

- Networking

- Others – Loan processing, insurance provider, comparison engine, etc.

2. Research the Market – Check growth statistics for each sector to discover business potential. Sectors like Digital Banking have recorded a 100% marketing-driven growth while investment apps have shown a 60% rise.

Isolate the factors that are driving the growth and ideate on how to capitalize it. How can you extend the growth using a Mobile app?

3. Feasibility Study – You may want to go with Mobile Wallet but the capital requirements and technical hassles may go out of your capacity. Hence, conducting a feasibility study is the first step to check whether the idea holds up at least on the paper.

Choose a sector wherein the scope of growth matches your scope of development. Consult a Fintech App Development Company.

2. Finalizing Tech Stack

Problem Statement – Settling on a technology that can offer the best usability results for the mobile while keeping development factors aligned.

The tech stack refers to architecture on which the app is built. This includes the database, the front-end, the server and the Operating System. The best tech stack is the one that offers the most technical advantages for implementing the solution and incurs the minimum amount of effort, to build the app.

Questions to Ask

- Which tech stack offers the best roadmap for implementing the idea?

- Are other Fintech Apps using this tech stack?

- How much time and costs will be invested in, using this particular technology?

- Are Fintech App Developers for the tech stack easily available?

- Is community support and constant updates available for the tech stack?

- How long before the tech stack goes out of scope?

- Does it solve scalability, security and maintenance challenges?

Solutions

1. Compare Popular Tech Stacks – Make a side-by-side comparison of the most used tech stack for Fintech App Development, to rank the most suitable options as per your needs. Refer to the pros and cons of each tech stack to settle on one.

A Tech stack has the following key components:

- Operating System – Android, iOS, Windows

- Server – Node.js, Apache Tomcat, IBM WebSphere

- Database – MySQL, SQL Server, MongoDB, Firebase

- Backend – Python, Dot NET, Ruby, JAVA

2. Cost and Effort Constraints – Identify if your project’s constraints can be accommodated in the given tech stack. For instance, is it possible to develop an Android app with 6 months of timeframe and $20,000 of capital? The right tech stack is the one which will help you meet your project’s technical goals within the project’s economics.

3. Consult a System Architect – A System Architect’s primary job role is to plan the various components to be used for an application. A Fintech Software Development Company will help you gain access to an architect who could help you make the right decision early on.

3. Identifying App Development Complexities

Problem Statement – Clearly documenting and classifying the features that the mobile app will offer, with rollout timelines.

A mobile app can be designed to solve 100 problems at once with low impact or 1 problem continuously with high impact. Identifying which all problems you wish to solve will determine how complex the app will become. Again, the complexities of the app must be balanced with available resources to build the app.

Questions to Ask

- What are the top 5 problems that the mobile app is solving?

- Are all the 5 problems necessary to be solved initially?

- How many features will the end-user get in the first release?

- Is the app a complex solution to a simple problem?

- Are the required features different from desired features?

- How will the cost of the project change with the number of features?

Solutions

1. Creating SRS – SRS stands for Software Requirement Specification which is used to clearly lay down the project’s scope, deliverables, features, challenges and expectations. It’s a document that helps you plan your mobile app wisely, and develop a roadmap for execution.

2. Managing Expectations – As a business owner, you must know that the mobile app will grow incrementally. It can’t solve all the market problems at once, and it must be scaled with time.

Therefore, begin with a few but critical features that best reflect the solution. Only implement the core of the App in initial stages, and then move towards the peripheral features.

3. Creating an MVP – Minimum Viable Product is a great idea for quickly creating a Proof-of-Concept, and is readily marketable. It’s an early version of the app that only has the inevitable features. Once the MVP passes in the public eye, additions can be made to it. It helps manage the complexities in a planned and frugal manner.

4. Defining Right User Experience

Problem Statement – Planning the components that’ll form the User Experience of the App for the best usability standards.

User Experience (UX) refers to the ease-of-use, interactiveness and interface design. It’s about how the app will look and feel like. UX can be designed in a million ways, and choosing the most suitable one is a challenge. Usually, it grows over time, but the standard and framework have to be laid initially.

Questions to Ask

- What platforms will the Mobile App support?

- What level of UX refinement is expected initially?

- What are the key features or patterns of other Fintech Apps?

- What front-end technologies will be used for it?

- Does the UX help solve user needs as easily as possible?

Solutions

1. Study the Target User – The right inspiration for a great UX comes from nowhere but the user. The design has to reflect the user’s persona, solve the user’s problems and consider the user’s behaviour patterns.

This can be done by studying metrics like;

- The age group of the user

- Design Preferences

- Usage Habits

- Design Challenges

- Behavioural Economics

- Interactivity Features

2. Employ Design Thinking – Design Thinking is an iterative process by which Fintech App Developers can improve the UX. It involves a constant cycle of creating ideas, testing them and taking feedback. It’s a highly powerful exercise for a great UX and is recommendable while designing the UX for your Fintech App.

3. Hire a UX Expert – UX decisions influence the tech stack and the timeline of the project, hence taking expert advice from a Fintech UX expert will be pragmatic. Making radical changes to the UX later can become costly, and time-consuming. Therefore, deciding the right UX upfront will need some expertise.

5. Ensuring Data Privacy and Security

Problem Statement – Figuring out the best security and data protection practices that must be implemented in the Fintech app for smooth operation.

Fintech Apps require extra caution and strict security standards because the data at stake is critical in nature. The system that will be handling the data has to be robust enough to keep the user data secure, theft-free and usable at all times. Moreover, it should meet the privacy guidelines published in the region where the app is active.

The famous Equifax breach wherein private data financial records of 147 million Americans were compromised continues to be an alarming reminder for enforcing security standards in your Fintech App.

Questions to Ask

- Is the app secure enough to process financial data?

- Does it meet the security standards prevalent in the Fintech industry?

- Are the security protocols taken while developing the app?

- What all things must be kept in mind while implementing security?

- What are the popular security and privacy laws that must be followed for Fintech Apps?

Solutions

1. OWASP Security Checklist – The Open Web Application Security Project or OWASP has published a Mobile Application Security checklist that must be followed in order to cover all bases. It’s a widely used standard for ensuring that the core fundamentals of security are met.

2. Penetration Testing – One of the best ways to create hack-proof systems is by forcefully breaking them on purpose, in controlled environments. Penetration testing refers to the practice of “trying to break into ” a secure system to check its strength. Hiring Cyber Security experts and Pen Testers will help you build strong standards grounds-up.

3. Organizational Security Approach – The weakest link in any security system is always the human. Therefore, adopting a security-centric approach in your workplace will prove instrumental in ensuring that your Fintech Mobile App is secure against insider threats, social engineering and risks of carelessness.

6. Complying App with Government Regulations

Problem Statement – To make the App technology and business approach comply with government regulations.

Most governments have Data Security and Fintech Laws in place to protect the end-user interest. Being a Fintech solution, these laws will extend to every aspect of the project, from technology to business model. Meeting these guidelines and successfully incorporating compliances in your app will be one of the inevitabilities of the project.

There are heavy penalties in case lapses or discrepancies are found in the App or the organization around it.

Questions to Ask

- What are the guidelines and laws pertaining to Fintech Apps?

- How can these guidelines be complied with?

- What happens when the guidelines or laws are not complied with?

Solutions

1. Meet the Key Compliances – Some of the key areas that demand compliances to be met are mentioned below:

- Due Diligence

- Money Laundering

- Data Protection

- Asset and Wealth Management

- Financial Transaction

- Lending

- Cryptocurrencies

- Account Aggregation

The Fintech compliances in India are supervised by the Reserve Bank of India, Securities Exchange Board of India and Ministry of Electronics and Information Technology. The legalise surrounding the compliances can be found here.

2. Hire a Mobile App Technology Consultant – In most cases, you will need a consultant who would help you navigate the compliances and meet them without error. Fintech is a peculiarly risky domain, and leaving the critical matters to the hands of experts is recommendable.

7. Integrating Artificial intelligence and Big Data

Problem Statement – Developing a strategy to leverage AI and Big Data ideally for business benefits, while overcoming technical hurdles.

77% of major financial institutions across the world expect that AI will become an irrevocable aspect of Fintech between 2020 and 2022.

It’s important to have a scalable AI system in place to gain path-breaking insights into business advantages. This clearly states the ubiquity of deploying AI and Big Data in your Fintech App. Easier said than done, implementing such solutions usually causes a number of technical challenges.

Questions to Ask

- When to implement AI and Big Data solutions in the Fintech App?

- What will be the key strategy for implementation?

- How will the impact of such implementation be measured?

- How will the fulfillment of talent and technology be done?

Solutions

1. Identifying the Scope and Timelines – While Big Data and AI are lucrative options for your Fintech App, the implementation needs to be planned meticulously. The technologies require a dedicated Fintech App Development Company that specializes in the same. This raises capital investment and time considerations. Therefore, make the decision once the product has been validated in the market and offers growth potential.

2. Hiring AI and Big Data Experts – The pragmatic step for overcoming this challenge lies in finding the right experts for the job. Luckily, you don’t have to hire in-house Data Scientists and Big Data engineers when you can outsource the project to a Fintech App Development company. This will help you achieve the goal with cost-effectiveness while ensuring success.

Conclusion

Your Fintech endeavour is backed by strong market favorability. Fintech Apps are growing in number and the industry is heading towards the trillion-dollar mark.

While challenges in deploying a Fintech App remain, you have a clearer perspective of the Big Picture with strong ideas on how to overcome the challenges.

The article addresses the problems, questions and solutions that every Techpreneur should know by heart, before stepping into the Fintech Industry.

TechTic, which is a Fintech App Development Company, offers its expertise to emerging fintech startups and new businesses globally. Begin your journey towards releasing a complete Fintech product on the App Store with us.

Latest Tech Insights!

Join our newsletter for the latest updates, tips, and trends.