10 Best Fintech Apps You Should Look Up to In 2022

Sector: Digital Product

Author: Chintan Bhatt

Date Published: 11/02/2020

Contents

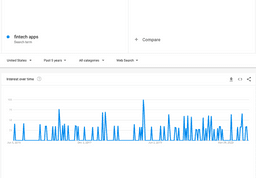

Fintech apps were less popular in the search compared to today in 2021. The upward search trend of the Fintech app started in 2020, which seems to be increasing in 2021 as well.

Cutthroat competition best defines the scenario in the realm of fintech. Ever since technology made its way into the finance sector, things have never been the same.

From offering us multiple modes of payment to making loans and credit cards easier and simpler, fintech application development has indeed made it convenient for laymen like us to enter the world of finance.

Read More: FinTech Trends to Watch in 2020-2021

Fintech Origin (Older Technology)

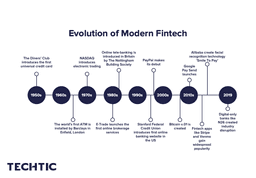

Fintech enables modernization that encompasses financial transactions, be it promoting a business or monetary operations. With the introduction of the credit card (in the 1950s) and the ATM (in the 1960s), fintech had since been transforming the common person’s space.

Fintech only referred to the back-office bank operations and share trading. However, with the introduction of the Internet and mobile computing, fintech got triggered to sustain a worldwide revolution.

Today, fintech has definitely taken a significant space in the digital world. With an intensifying family of advanced technological tools for both private and marketable finance, it is composed to further mature in usage and effect.

The 1970s involved the introduction of NASDAQ, which facilitated digital stock exchange and global interbank telecommunication, facilitating cross-border payments.

The world further saw E-trade launches, online telebanking, and the USA’s foremost online banking web portal.

Bitcoin was launched in 2009, trailed by other cryptocurrencies and advanced blockchain technology. Smartphones were adopted, and fintech applications became the fundamental means of connecting common people with on-the-go financial services.

Then, there came the age of start-ups, with a craving for novelty between monetary investors and end-consumers, which further steered the world of fintech with innovative financial products and services. With banks initiating to act and brand as innovative start-ups, the Fintech 2.0 era led to Fintech 3.0.

Furthermore, Google Payments introduced a revolutionary era of fintech apps and Alibaba’s facial recognition technologies to drive financial dealings.

In 2019 and beyond, the original technology that has determined the Fintech 3.5/3.5 space, like blockchain and digital-only banking, continues future innovations.

Fintech Industry Size 2021

As per current fintech statistics, with case studies on six adaptive such as Australia, Hong Kong, Singapore, Canada, the UK, and the US, they have risen from 16 percent in 2015, mounting to 31 percent in 2017, and maturing to 60 percent in 2019. So, the fintech sector is an ever-progressive platform.

There is a steady maturity while observing digital financial services such as payments, money transfers, investments, and borrowing. We have compared the fintech categories concerning the acceptance rate from 2015 to 2019.

As per Statista, around 75% of Millennials in the US switched to digital banking, which will boost to 77.6% by 2022. This will lead to massive growth opportunities for digital finance services.

Over the last few years, there has been dynamic growth in fintech app development. Over 64% of the consumers across the world have at least used one fintech app in 2019. Not just that, the market is anticipated to grow at a 6% CAGR to value at $26tn in 2022. What’s equally interesting is that there are over 48 unicorns in fintech with a combined worth of around $187bn.

Types of Fintech App

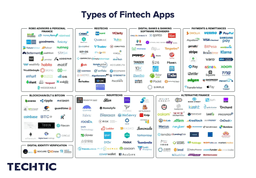

Several types of fintech apps are launched by companies and used by different users. This categorization can be done on the basis of the industry to which their customers belong, including significant categories like lending, global money transfers, payments, and consumer banking. Other fintech app types comprise equity financing, insurance, and personal finance.

Today, many commercially accessible applications provide advice and assist end-users. Many such fintech companies have grown internationally, but only some are universally acquainted and steady than others.

Fintech Categories and sub-verticals

The banking as a fintech category is mainly kept back for conventional banks, who are swiftly scaling and progressing into all domains of fintech. The other categories and sub-verticals include Budgeting, B2B services, Credit history & monitoring, decentralized finance (Defi), modern-day Cryptocurrency, and innovative concepts which turned into reality like Buy now, pay later (BNPL).

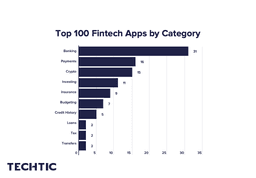

Top 100 Fintech Apps by Category

Banking is the prime sector by a number of applications. On the other hand, payments are the biggest sub-vertical in the fintech apps category. Crypto is ranked higher concerning recent investments. However, later on, the types start to narrow out.

Payment apps are used extensively on a day-to-day basis and are precisely built to make a minute portion of each transaction and still generate large-scale revenues. They offer innovative features over time or introduce related services to enable users and B2B customers.

It is an influential status to be in the fintech sector, which is why Apple and Google are contending aggressively in this business space.

From 2020 to 2024, Worldpay has predicted that the credit card share of online retail sales in North America will see droppings from 23 percent to 21 percent, whereas there will be a boost in the use of payment apps from around 45 percent to 52 percent.

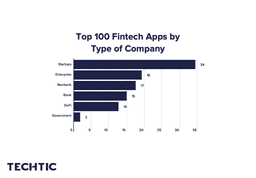

Top 100 Fintech Apps by the Company

We can explore the data by iOS and Android so you can classify them down. Undoubtedly, neobanks are more found on Android than iOS, and however, the rest is equitably close amid the leading platforms. Note that 78 of the topmost 100 fintech applications on both these platforms are reproductions.

So, if you’re someone who intends to make the most of the situation by launching your own fintech app in the market, we have got you covered. This post contains the ten best fintech apps you should know about so you understand what they do, how they operate, and carve a space for your fintech company accordingly.

So, what are we waiting for?

Let’s get started.

10 Best Fintech Apps in 2021 Inspires Fintech Startups

No. | Fintech Apps | Total Valuation | Country | Play Store Link | App Store Link |

1 | MoneyLion | $2.9 Billion | USA |

| |

2 | Robinhood | $32 Billion | USA | ||

3 | Chime | $25 Billion | USA | ||

4 | Nubank | $30 Billion | Brazil | ||

5 | Mint | $103 Million | USA | ||

6 | Revoult | $33 Billion | UK | ||

7 | Coinbase | $85.7 Billion | USA | ||

8 | N26 | $3.5 Billion | Germany | ||

9 | Finch | $15 Million | USA | ||

10 | Tellus | $265 Million | USA |

1. MoneyLion

Country: United States

This top fintech app is the go-to app for consumers who look to seek financial advice and loans. In the market for over six years, this top fintech app is a blend of savings, lending, and wealth management aspects. This is an ideal financial companion consumers can resort to for any finance-related assistance. It operates on a subscription-based model that also includes the setting up of the bank account of users. Besides this, it offers banking services.

Top Features of the MoneyLion Mobile Banking App

- Immediate transfer and no checking fees

- Straightforward deposit for APR cash advances

- Around 12 % of cashback rewards

- Checking of the credit score

- Quick notifications of transactions

Advantages of MoneyLion Mobile Banking App

- Savings, investments, borrowing all in one place

- Effortless to access loans

- Each user gets cash backs

- Membership comes with significant benefits

Disadvantages of MoneyLion Mobile Banking App

- Restricted investment choices

- The pricing of the app is quite complicated and is completely feature-based

2. Robinhood

Type of Fintech App: Investment

Country: United States

With a pop-culture name, this fintech app is a stock trading app available for free. With this app, users can trade stocks, indices, and even cryptocurrencies at zero commission charges. It has an amazing integration with over 3,500 banks in the US to provide optimum trading experiences to consumers, making it one of the best fintech apps of 2021. Thanks to its services and features, this venture is now valued at around $8bn today.

Top Features of the Robinhood App

- Multiple investment preferences

- Dynamic market data analysis

- Cash handling tools

- No trading commissions

Advantages of the Robinhood App

- Quick and simple to open digital accounts

- No fees on stock and ETF trading

- Offers numerous integrations for enabling deposits and handling bank accounts.

- It backs web and mobile-based platforms

Disadvantages Features of the Robinhood App

Limited access to instructive material and reports

Restricted product choices and poor support

3. Chime

Type of Fintech App: Mobile Banking

Country: United States

Chime is another top mobile fintech app of 2021, which is also known as one of the fastest-growing mobile-only banks. It allows consumers to better manage their expenses and savings in one place. It levies zero transaction charges and offers free ATMs across the country. One of the best features of the app is that it automatically helps you save by deducting 10% of the amount credited to your account and transferring it to your savings account. Mom, is that you?

Top Features of Chime Mobile Banking App

- The deposit goes straight to the Chime account

- Receive payments early

- No monthly or other hidden fees

- No costs on sending funds to friends & family

- Deposits can be immediately checked

- Back mobile payment applications

Advantages of Chime Mobile Banking App

- It merely charges the fees for ATM and possesses immense access to a number of ATM’s

- It enables users to have swift and simple direct transfers

- Save automatedly when you spend and when you receive payments

Disadvantages of Chime Mobile Banking App

- The savings account has lower rates of interest

- Bounds the transfer of funds from savings

4. Nubank

Type of Fintech App: Online Banking

Country: Brazil

Based out of Brazil, this top banking app of 2021 offers information to consumers about saving balances, rewards, and credit cards in real-time. With over 12mn customers, Nubanks ranks sixth in its home market. It emphasizes the importance of user experience by having a very simple user interface with minimal learning curves to accommodate users from all walks of life. Also, the company’s blog publishes several educational posts on diverse fintech topics.

Top Features of Nubank App

- Savings at user clearance

- No-annuity credit card recognized globally

- Access to rewards point programs

- Insightful articles and blogs

Advantages of Nubank App

- Zero transaction-based fees with unrestrained TED

- Credit cards are recognized globally with no annuity

- Straightforward and smooth user interface

Disadvantages of Nubank App

- Fixed fees applicable to every fund withdrawal

- The app automatedly logout the users, which generates awkwardness for them

5. Mint

Type of Fintech App: Personal Finance

Country: United States

Mint is regarded as one of the most precise fintech apps to collect consumer information such as accounts, credit scores, transactions, and more. The app offers financial advice, reminders to pay bills and settlements, and detects patterns in spending data to come up with the most valuable insights on saving on expenses. It has one of the tightest encryptions in the fintech realm.

Top Features of Mint App

- Handle all the bills and balances

- Set a budget and receive funds suggestions

- No fees for credit score analysis and advice

- Secured and safe app sign-up

Advantages of Mint App

- Alerts and notification of transactions and account related activities

- Simple to download transactions

- Income and spending categories can be tailored

- Get the precise net worth of vehicles, residences, and physical assets

Disadvantages of Mint App

- It doesn’t back multi-currency transactions

- Users cannot allocate numerous savings targets to a single account

6. Revolut

Type of Fintech App: Online Banking

Country: United Kingdom

Revolut is yet another top fintech app that offers a blend of banking services and finance management services to its consumers. As far as banking services are concerned, it offers currency exchange, P2P payment systems, cryptocurrency exchange, debit cards, and more. When it comes to financing management services, it offers budgeting, real-time currency exchange facilities, and more.

From the app’s mobile banking features, you could send money in over 25 currencies and withdraw in over 120 currencies across the world. Concerning cryptocurrencies, it supports Ethereum, Bitcoin, Bitcoin Cash, Litecoin, and more.

And did we also mention that it offers you overseas travel insurance and a feature that makes splitting bills with your family simpler?

Top Features of Revolut Mobile Banking App

- Prompt spending notification after each card payment

- Fix a monthly budget for supplies to handle finance

- Access to international travel insurance

- Fragment the bill calculations between friends and family

Advantages of Revolut Mobile Banking App

- Zero fees for account opening and sustenance

- The application can deal with multiple currencies

- It has modern fintech functionalities such as crypto-trading

- Subscription with convenient perks

Disadvantages of Revolut Mobile Banking App

- No current account services though the app has a banking license

- Sluggish support and facilities to end-customers

7. Coinbase

Type of Fintech App: Cryptocurrency Wallet

Country: United States

If you’ve been following us, you would have noticed that we have always shed light on blockchain and its potential in fintech software development. Well, Coinbase is one of those companies that stands as a testimony to this. Based on blockchain technology, it is one of the largest cryptocurrency exchange fintech apps in the USA.

With this app, you could look at the value of cryptocurrencies in real-time and invest and trade in any of them by scheduling their purchases. It has over 25 million users in over 32 countries. One of the best aspects of this app is that close to 98% of the cryptocurrency is secured and stored offline. The rest is secured by state-of-the-art online security infrastructure and protocols.

Top Features of Coinbase App

- Handle the investment portfolio

- Invest in dynamic buying and selling

- Vault safety with delayed funds drawings

Advantages of Coinbase App

- The app enables immediate transfers amid Coinbase user-base

- It makes sure all deposits of Bitcoin

- Supports 2FA and multi-signature security

- It offers access to web and mobile wallet services

Disadvantages of Coinbase App

- It does not back cryptocurrencies

- There are delays in fund deposits and withdrawals

- Sluggish support with continuous account tracking thus no user secrecy

8. N26

Type of Fintech App: Finance Management

Country: Berlin

This fintech app is based out of Berlin, Germany, and allows you to take instant charge of your finances after installation. It offers you transparent money management tools so you could save better and spend wiser. Besides, it also offers you up to 2 free withdrawals in ATMs. You could also use the app to initiate instant money transfers and get full-fledged insights into your spending statistics.

Top Features of N26 App

- Instantaneous money transfers

- Automated creation of spending details

- Security measures with face or fingertip acknowledgment

- Establish and attain financial goal lines with Spaces

Advantages of N26 App

- The application has a legal banking license

- Zero charges for opening and sustenance of accounts

- A user can gain a premium subscription with accessible incentives

Disadvantages of N26 App

- The application can clutch merely one currency

- Chat provision is sluggish, and there is no phone support

- Lacks essential features when compared to the competitor apps

9. Finch

Type of Fintech App: Personal Finance

Country: Australia

Finch is designed for today’s millennials who can be seen with mobile at any given point in time. With Finch, the company aims at making finance more social and easier. The app allows users to send and receive money without needing to know any bank details. Besides, users can also use the app to track expenses, split bills and do more.

Top Features of Finch App

- Enable personal finance for users

- Manage budget and sharing of group bills

- Easily make payments to friends

- The app is pretty flexible to use

Advantages of Finch App

- The app is free to use and explicitly tracks spending of bills

- Offers financial and budget statistics

- It helps compare the user spending with other app members for monitoring finances

Disadvantages of Finch App

- The app is pretty new, with limited comments and feedback to draw any probable red flags.

10. Tellus

Type of Fintech App: Cash & Real Estate

Country: United States

One of the niches and specific implementations of the fintech industry is Tellus. This fintech app is designed and developed to foster a seamless transactional environment for landlords and tenants. It allows app users to collect rent, pay rent, maintain all tenant information in one place for easy access and retrieval, perform screening of tenants, initiate services and repairs, in-app messaging, file sharing, and more. Truly a useful app.

Top Features of Tellus App

- The application has access to personal finance, wealth, and property management

- One-stop platform for tenants and landlords

- No fees or limits to fund deposits

Disadvantages of Tellus App

- Security is not up to the mark

- Notification features have limited functions

Wrapping Up

So, these are the top 10 fintech apps that work as an inspiration for banking and finance companies in 2021.

If you have an idea to build your Fintech product, you can learn how they’ve built such kinds of apps and plan yours. And if you think you need assistance in validating your idea or making an app better than the above ones, you can reach out to our Fintech app development experts.

Get started with us today.

Latest Tech Insights!

Join our newsletter for the latest updates, tips, and trends.