7 Fintech development skills every developer must have

Sector: Digital Product, Technology

Author: Nisarg Mehta

Date Published: 05/05/2022

Contents

The global fintech market will reach $190 billion by 2026, growing at 13.7% CAGR.

Fintech is an umbrella term that refers to a variety of businesses that use software and technology to provide financial services. This includes robo-advisory and asset management companies, online lenders, online banks, peer-to-peer lending platforms, mobile payment companies, and online remittance companies.

The fintech industry specializes in disruptive innovations that are redefining financial services, reshaping the financial landscape, and pushing traditional-only models out of the market. Fintech democratizes finance in many ways, making it more accessible to both personal and commercial users, and taking the guesswork out of financial decision-making.

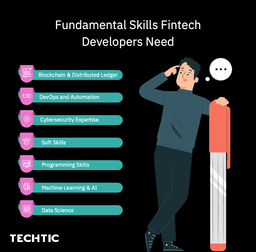

Fundamental Skills Fintech Developers Need

The behavior and habits of fintech users have changed significantly since the pandemic and will continue to change in the near future. The popularity of various payment systems (contactless payments, e-wallets, and online payments), financial literacy, and consumer knowledge of fintech products, has skyrocketed.

This, without a doubt, creates a demand for people with fundamentally new knowledge and abilities required for fintech.

As a result of the widespread deployment of new payment infrastructure, a new generation of professionals has emerged. Let’s talk about the attributes that make them unique and useful.

1. Blockchain & Distributed Ledger

Blockchain technology is synonymous with security and is used in digital money transfers using bitcoins or cryptocurrency. Many consumers have witnessed a consistent rise in the value of digital currencies such as Bitcoin, XRP, and Ethereum over the last decade.

These technologies have caused havoc in the core banking industry. Blockchain technology enables a simpler lending process, transactions, and money reconciliation by utilizing a single, shared, consensus, and ‘ledger’-based transaction system.

The use of blockchains allows for the execution of contracts and agreements without the involvement of attorneys or bureaucratic red tape, ensuring the security of investments through the use of smart contracts to manage risks efficiently. Copyrights can also be easily confirmed.

2. Machine Learning & AI

Modern solutions make use of data algorithms, which rely on the ability to interpret data and make decisions based on it for business execution. Loan approvals, credit limit increases, and risk scores are all codifiable algorithms that use data as input. Moving to a decision-making model that does not require human intervention can provide obvious business benefits.

Of course, machine learning and artificial intelligence have a wide range of applications in fintech, so understanding even basic concepts can improve your ability to contribute to the fintech’s mission.

Process automation is one of the most common applications of machine learning in finance. Businesses that use process automation can reduce the manual aspect of their work and expect accurate results.

3. DevOps and Automation

The need for process automation is growing. DevOps juggles operations and development simultaneously. This leads to faster deployment and efficiency. Businesses have adopted a DevOps approach in line with the increase in relevant data and the necessity to automate and process the information.

4. Data Science

As technology disrupts and redefines financial services, it also generates massive volumes of usable data that must be analyzed, evaluated, and scrutinized. Knowledge of technologies such as Machine Learning, Artificial Intelligence (AI), Big Data, and Deep Learning is necessary for this purpose.

Data science is extremely important in financial institutions since it aids businesses in forecasting the future using data analysis. Businesses can use data science to assess risks and avoid fraud. Data scientists should be able to visualize and interpret large volumes of data.

5. Cybersecurity Expertise

Fintech start-up companies are especially vulnerable to malicious cyber threats. Such attacks on their financial and cyber systems have a monetary impact, but they also have other abstract but serious consequences: they can result in data loss, damage reputations, strain business relationships, have serious legal ramifications, and negatively affect employee morale, potentially leading to higher employee attrition rates.

Important cyber security skills needed include incident investigation and response-ability, governance, risk management and compliance (GRC), digital communication technologies, encryption methods, and analytical skills.

6. Programming Skills

Python Power

Python is an excellent programming language for developing analytic tools, quantitative models, pricing tools, and risk and trade management platforms, which are all used in creating trading strategies at hedge funds and investment banks.

Java Expertise

Since its implementation, Java programming software has been widely utilized by financial institutions and has been the major programming language within banks.

Fintech firms are now adopting Java software for a wide range of projects, from order management systems to low-latency execution to risk and valuation platforms in-house. Java is also used to construct website pages that are smooth, secure, and quick to load.

C ++ & C#

The C++ programming language is appropriate for software infrastructure and apps with limited resources. It has the ability to process big amounts of data quickly and is used to create applications for technical banking systems. The C# programming language is used to simulate and model data, as well as to create a Windows-based platform. It employs a mix of C and C++ programming languages.

Matlab

Matlab is a quantitative financial programming language used by fintech developers to construct user interfaces, generate and implement algorithms, visualize data functions, and form matrix manipulations. Matlab can also be used to connect with programs written in other languages such as Python, Java, C, C++, and C#.

R Skills

The R programming language is widely used by statisticians and data miners to create many sorts of statistical and data analysis software, as well as Big Data analytics tools. With the growth of Big Data, experts in the R programming language can effectively apply their knowledge in this regard.

HTML, Javascript & CSS

HTML, Javascript, and CSS are the essential abilities required of all software developers. For clients to engage well with online services, it is critical to establish smooth and fast user interfaces. These fundamental Front-End Development abilities provide additional insight into more sophisticated computing issues.

ETL Knowledge

As ETL technologies become more important for successful data warehousing and the organization of massive data quantities. Cassandra, Hadoop, and Scala are examples of Big Data technologies that are progressively gaining traction as their utility grows in the face of Big Data and cloud computing technology.

7. Soft Skills

Multitasking

Multitasking refers to the ability to complete multiple tasks simultaneously while moving seamlessly from one to the next.

Multitasking in the workplace necessitates analytic thinking, a strong systems view, and a high level of organization.

Communication and People Skills

The disruptive and fast-paced nature of fintech requires skilled employees with a high emotional quotient to outperform those with only technical skills. Other important people skills include the ability to collaborate effectively with others and work in teams and build relationships, share ideas, and manage conflict.

Communication skills enable the developer to understand the mentalities and working aspects of other team members, and to avoid conflicts.

Business Administration

The ultimate goal of every business is for it to work like a well-oiled machine, and the person in charge of achieving this is known as a business manager.

Business management’s goal is to appropriately agree on a set of tasks and their coordination, which is critical for any fintech company’s success.

Creativity and Problem-Solving

The fintech industry is confronted with a slew of technological, legal, and regulatory challenges, and unexpected events. Fintech professionals must be analytical and critical thinkers in order to find creative solutions to such problems.

Build your team of Skill-fit Fintech Developers

Fintech is poised to transform the way we spend, manage, save, and invest our money. This field is still being transformed by innovation, and it will continue to do so for the foreseeable future. Job seekers that want to be a part of this burgeoning field are people who want to use evolving technology to rethink established approaches.

Techtic Solutions is a renowned fintech app development company. Our world-class fintech solutions assist you in developing the most advanced fintech apps so that you may provide your banks and financial institutions’ customers with convenient, dependable, and trustworthy custom fintech software solutions.

If you’re looking to build a smart fintech app, Techtic solutions can help you achieve your goal. Get in touch with us today!

Latest Tech Insights!

Join our newsletter for the latest updates, tips, and trends.